MongoDB’s shares surged by 16% in extended trading following the release of its fiscal second-quarter earnings report. The company exceeded LSEG consensus expectations with an adjusted earnings per share of 70 cents, compared to the expected 49 cents. Additionally, MongoDB reported revenue of $478.1 million, surpassing the anticipated $464.1 million.

In the quarter ending on July 31, MongoDB experienced a revenue growth of 13% year over year. Despite the positive revenue growth, the company reported a net loss of $54.5 million, or 74 cents per share. This marked an increase from the previous year’s net loss of $37.6 million, or 53 cents per share.

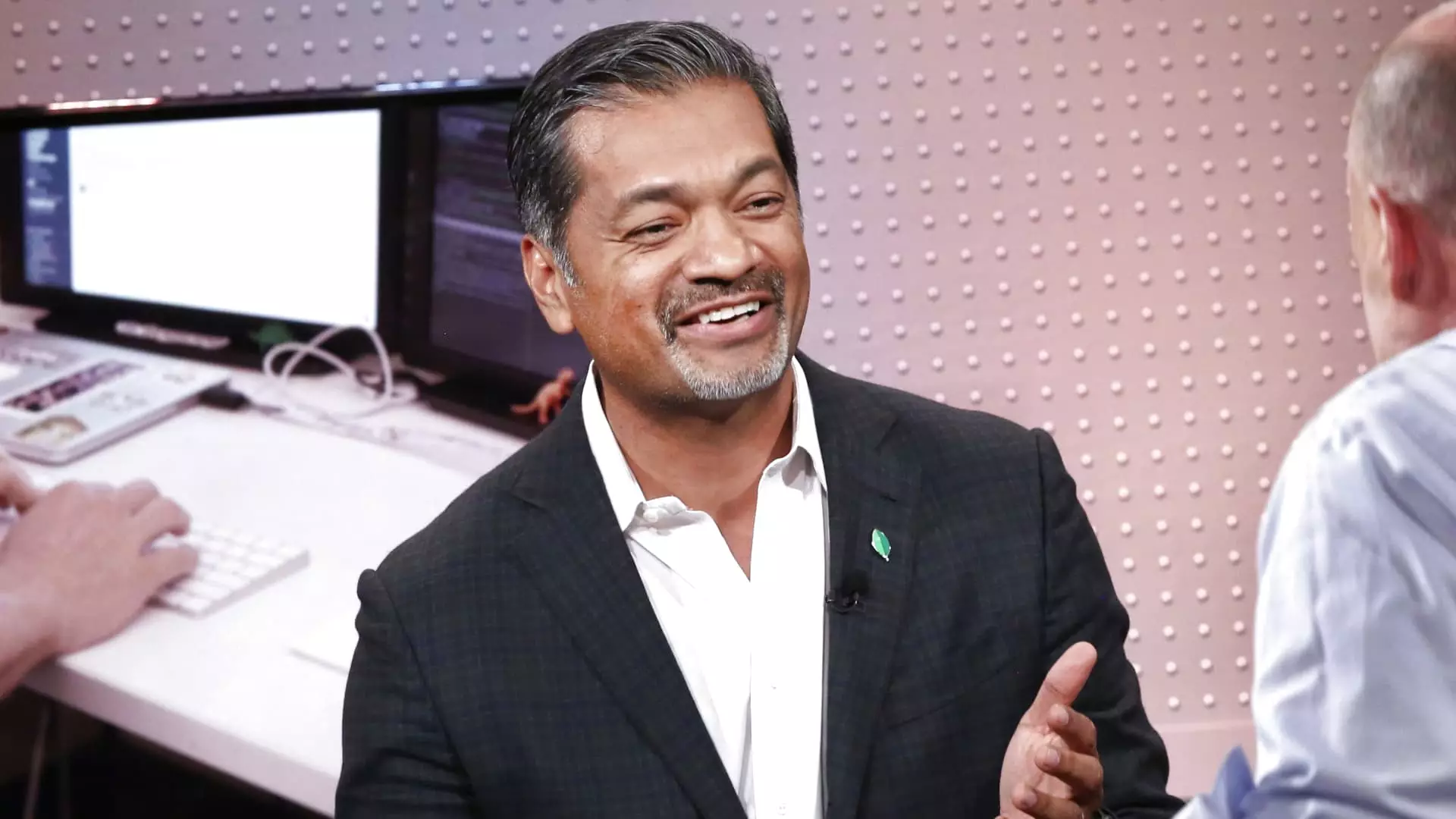

CEO Dev Ittycheria expressed confidence in MongoDB’s ability to assist customers in integrating generative AI into their operations and modernizing legacy applications. The company’s Atlas cloud database service performed better than expected, demonstrating strong consumption levels. Ittycheria noted that despite economic challenges affecting client consumption growth in the fiscal first quarter, the trend continued into the second quarter.

MongoDB provided guidance for the fiscal third quarter, anticipating adjusted earnings of 65 to 68 cents per share on revenues of $493.0 million to $497.0 million. The company also raised its fiscal 2025 forecast, now projecting adjusted earnings of $2.33 to $2.47 per share with revenues of $1.92 billion to $1.93 billion. This update represents an improvement from the previous guidance, indicating strong growth prospects for the company.

Market Performance

Despite the positive earnings report, MongoDB’s shares were down nearly 40% year-to-date, contrasting with the S&P 500 index’s 17% gain over the same period. The market reaction to MongoDB’s financial performance highlights the challenges and opportunities facing the company in a competitive landscape.

MongoDB’s robust fiscal second-quarter earnings and revised full-year guidance demonstrate its resilience and strategic positioning in the database software market. The company’s focus on innovative solutions and customer-centric approach bodes well for its future growth and success.

Leave a Reply