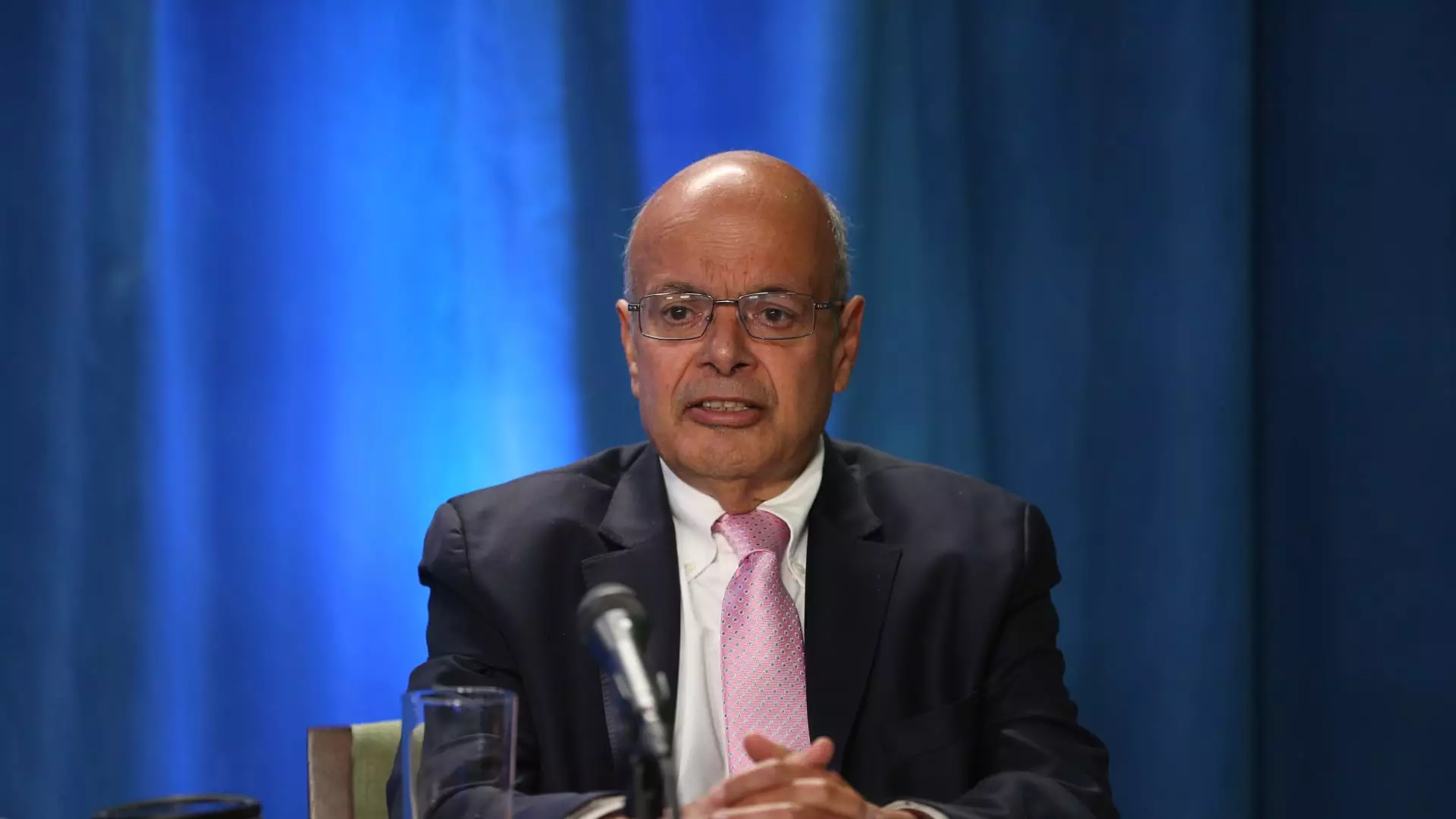

In a significant development coming out of Berkshire Hathaway, Ajit Jain, the esteemed vice chairman of insurance operations, has made headlines by divesting a substantial portion of his stake in the company. According to recent regulatory filings, Jain sold 200 shares of Berkshire Class A stock on a particularly busy Monday for an eye-popping average price of approximately $695,418 per share, which equates to around $139 million. This sale resulted in him holding a mere 61 shares, in addition to the holdings of family trusts and a nonprofit organization he established, which together maintain an additional 105 shares. What is striking, however, is that this sale represented a staggering 55% of Jain’s total holdings in Berkshire.

The timing of this transaction could not be more interesting. Jain’s decision to sell comes at a time when Berkshire shares had soared above $700,000, achieving a market capitalization of $1 trillion by late August. Some financial analysts suggest that this move might signal Jain’s perception that Berkshire’s stock has reached its peak or is “fully valued.” This sentiment is echoed by financial expert David Kass from the University of Maryland, who interpreted Jain’s actions as a strategic retreat amid prolonged high valuations.

Moreover, this sale coincides with a noteworthy slowdown in the company’s share buyback activity. In the second quarter, Berkshire Hathaway repurchased only $345 million of its own stock, in stark contrast to the robust $2 billion bought back in each of the previous two quarters. Bill Stone, Chief Investment Officer at Glenview Trust Co., provided further insights into this trend, stating that the current stock price, which is over 1.6 times its book value, reflects Warren Buffett’s conservative estimates of the company’s intrinsic value. Stone hinted that investors should not anticipate significant stock repurchases under the current valuation conditions.

Ajit Jain’s stature within Berkshire Hathaway is irrefutable. He has been a pivotal figure in steering the company’s insurance operations toward unprecedented success since joining in 1986. Notably, he has played a crucial role in guiding Berkshire’s foray into the reinsurance market and recently was instrumental in revitalizing Geico, long considered one of the company’s flagship ventures in auto insurance. His contributions to the business have been so substantial that Warren Buffett himself acknowledged Jain’s impact in his annual letter to shareholders in 2017, suggesting that Jain has created “tens of billions” of value for shareholders.

This considerable reshaping of Berkshire’s insurance portfolio and Jain’s acumen in generating profits have positioned him as a potential heir in the leadership line behind Buffett. While prior speculation hinted that Jain might succeed Buffett when the time comes, recent clarifications indicate that Jain has no aspiration to take the helm of the conglomerate.

Speculations on Future Moves

Jain’s recent sale brings forth several questions regarding the future direction of both his investments and Berkshire Hathaway’s market strategies. Analysts speculate whether this could foreshadow a shift in investment philosophy, as Jain could be signaling a temporary pullback in high-risk equity investments or might even be positioning himself for future opportunities. The drastic reduction of his holdings suggests a strategic realignment, possibly in anticipation of changing market conditions or personal financial planning.

As both shareholders and market watchers monitor these developments closely, it remains to be seen what implications this significant sale will have on the broader market perception of Berkshire Hathaway and its investment strategies moving forward. Continued fluctuations in Berkshire’s stock price, coupled with changing dynamics in the investment landscape, will undoubtedly frame the discourse in upcoming months.

Jain’s substantial divestment is a reflection of personal and market considerations that could reshape the narrative surrounding Berkshire Hathaway and raises pertinent questions about the conglomerate’s future in a rapidly evolving financial environment.

Leave a Reply