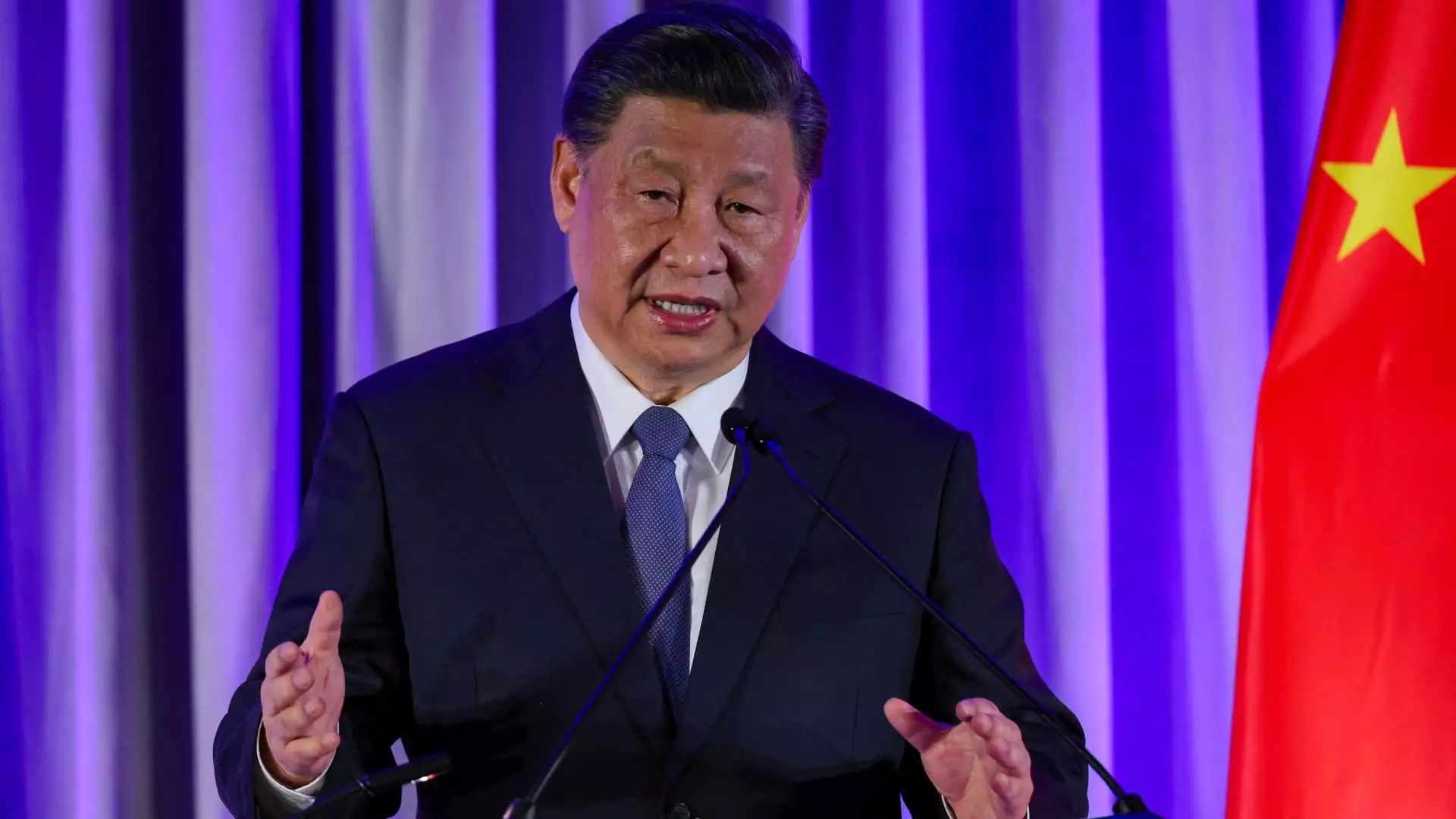

In recent times, China’s economy has faced significant challenges, particularly within the real estate sector, which has historically been a major driver of national growth. During a pivotal meeting held on Thursday, Chinese leaders, influenced by President Xi Jinping, expressed a clear intent to address the ongoing slump in property markets. State media reports indicated a commitment to halt the decline in the real estate sector and foster a stable recovery, acknowledging the rising concerns among citizens regarding financial stability and housing.

Understanding the Real Estate Crisis

The backdrop to this critical meeting can be traced back to regulatory changes introduced in 2020, aimed at curbing excessive debt among property developers. This crackdown has led to a steep decline in real estate activity, with the sector now contributing significantly less to the broader economy. Data indicates that real estate once accounted for over 25% of China’s GDP, but the accumulated effects of tightened regulations and a cautious buyer sentiment have taken a toll on both local governments and household wealth.

As the economy’s growth prospects dim, with predictions of falling below the targeted 5% GDP increase, the need for effective intervention has become more pressing. The meeting’s readout regarding fiscal and monetary policies hinted at a forthcoming strategy designed to rekindle this vital sector, although specific measures and timelines have yet to be detailed.

Attention was drawn to several proposed measures that could help rejuvenate the real estate market. Leaders underscored the importance of providing heightened fiscal and monetary support to stabilize and eventually revive the sector. There was also an emphasis on encouraging households to make purchases rather than simply aiming to appreciate housing prices for a perceived wealth effect.

One crucial aspect of this proposed strategy is limiting the growth of housing supply while simultaneously increasing lending to select projects. By lowering the burden of mortgage repayments, estimated to drop by over 150 billion yuan annually, the government hopes to break the current ‘wait-and-see’ mentality prevalent among potential buyers.

The announcement sparked a positive response in equity markets, with significant gains observed in Chinese property stocks, particularly in Hong Kong. This uptick suggests that investors are cautiously optimistic about potential recovery efforts outlined by the governing bodies. However, analysts remain divided on whether these preliminary signals will translate into substantial fiscal stimulus or if the government will adopt a more tempered approach focusing on gradual recovery.

Financial firms like Goldman Sachs have revised their economic forecasts downward, reflecting a broader sentiment that the government may adjust its growth expectations in light of existing challenges. Responses to the meeting, however, remain is mixed. Some analysts predict an escalation of proactive policies to further stimulate the economy, while others caution that the nature and scale of fiscal support remain ambiguous.

The Path Forward: Balancing Short-term and Long-term Goals

The Politburo’s takeaway from the Thursday meeting serves as a pivotal landmark in shaping China’s economic future. While past meetings have set aggressive targets for growth at all costs, the latest directives indicate a shift towards a balanced approach—one that endeavors to stabilize current growth trends while also addressing long-term structural challenges.

Despite a slight moderation in real estate sector declines noted in recent data, the outlook remains fragile. Economic activity has not yet fully normalized, and analysts suggest that China may have to settle for lower growth rates as the nation transitions towards a more sustainable economic model focused on innovation and high-tech industries.

This careful navigation between fostering immediate recovery and implementing necessary reforms is essential in fostering economic resilience. Policymakers face the task of inducing positive sentiment among consumers and investors alike, as they seek to promote stability in key sectors while addressing systemic vulnerabilities.

Thursday’s meeting represents a crucial step in China’s strategy to rejuvenate its real estate sector amidst a backdrop of economic uncertainty. The outlined commitment to stabilize and support the sector indicates an acknowledgment of the ideological shift needed to tackle pressing economic realities. Moving forward, how successfully these initiatives are implemented will be vital in determining whether China can reclaim its former economic dynamism—or adapt to a new paradigm of sustainable growth. The stakes are high, and the world will be watching as China endeavors to balance these complex demands within its economy.

Leave a Reply