Philadelphia Federal Reserve President Patrick Harker recently voiced his support for a potential interest rate cut in September. Speaking at the Fed’s annual retreat in Jackson Hole, Wyoming, Harker emphasized the need for monetary policy easing as a means to address economic challenges. Harker’s stance reflects growing confidence among officials regarding the trajectory of inflation and the labor market. He asserted that the process of lowering rates should commence in September to steer the economy in the right direction. While markets have already priced in a high probability of a quarter percentage point cut, Harker’s position on a 50 basis point reduction remains uncertain. Harker’s call for a methodical rate adjustment underscores the importance of strategic signaling and data-driven decision-making by the Federal Reserve.

Harker emphasized the non-political nature of the Federal Reserve’s decision-making process, regardless of the looming presidential election. He underscored the Fed’s role as a body of technocrats whose primary responsibility is to analyze economic data and respond accordingly. Despite not having a voting role on the rate-setting Federal Open Market Committee this year, Harker’s insights carry weight in shaping monetary policy discussions. The Fed’s commitment to data-driven and independent decision-making serves as a guiding principle in navigating economic uncertainties and challenges.

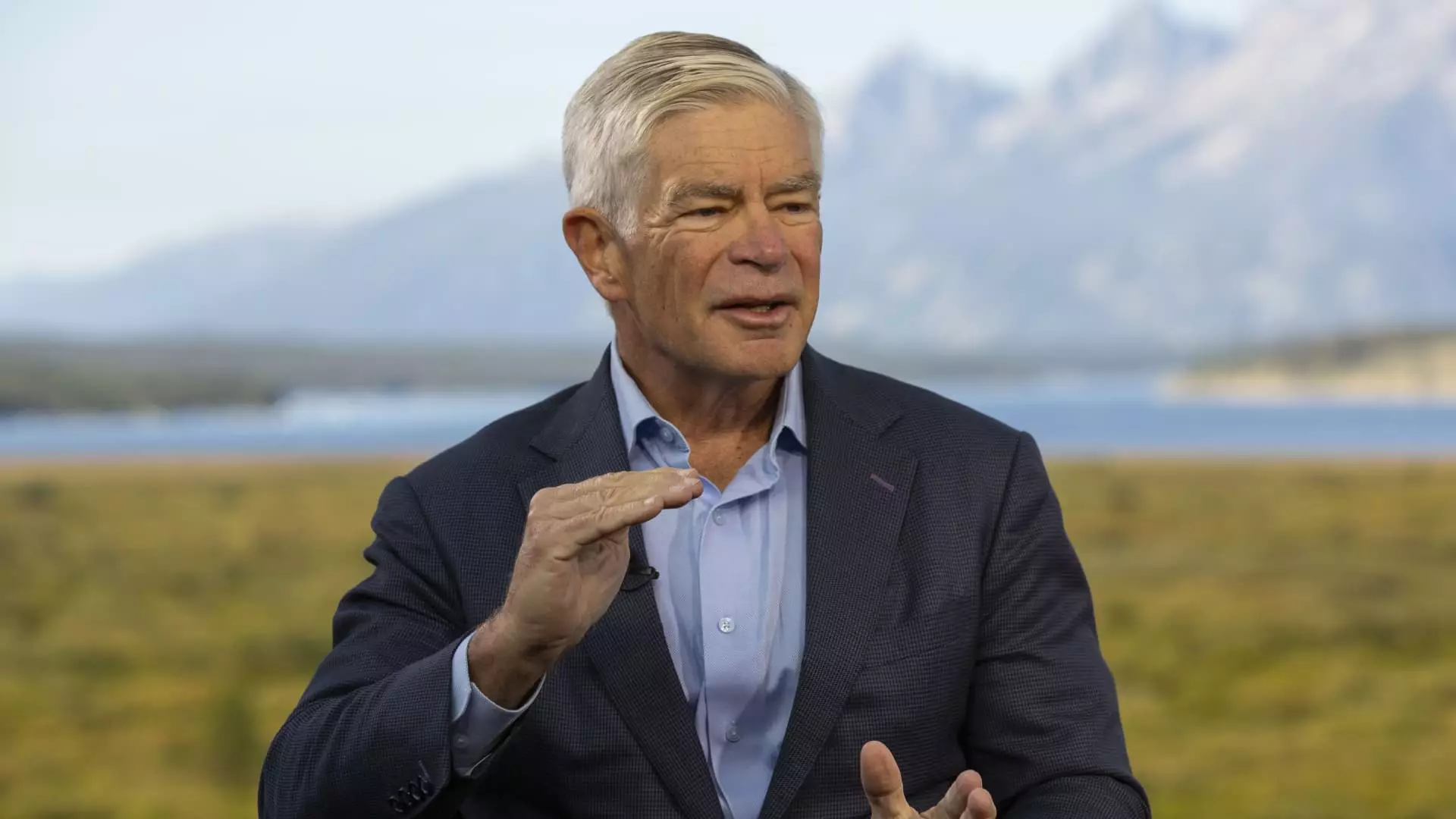

Kansas City Federal Reserve President Jeffrey Schmid offered his perspective on the potential for an interest rate cut in the near future. While not as explicit in his endorsement as Harker, Schmid acknowledged the changing dynamics in the labor market and the implications for monetary policy. The shift from a tight labor market to a more moderate one has alleviated some of the inflationary pressures seen earlier. Schmid highlighted the need for a nuanced approach to assessing the current economic landscape and considering the implications of policy adjustments. Despite acknowledging the importance of maintaining a balanced approach, Schmid hinted at the possibility of a rate cut as a means to address evolving economic conditions.

Both Harker and Schmid’s perspectives shed light on the complex interplay between economic indicators, inflationary pressures, and market expectations. The Fed’s approach to monetary policy reflects a delicate balance between addressing immediate challenges and fostering long-term economic stability. While the path to an interest rate cut remains uncertain, the Fed’s commitment to data-driven decision-making and independent policy formulation underscores its resilience in navigating economic headwinds. As economic conditions continue to evolve, the Fed’s role as a steward of monetary policy will be crucial in sustaining economic growth and stability.

As the Fed prepares for upcoming meetings and deliberations on monetary policy, the insights from Harker and Schmid offer valuable perspectives on the road ahead. The need for a proactive and strategic approach to interest rate adjustments underscores the Fed’s commitment to addressing economic challenges effectively. While uncertainties persist in the economic landscape, the Fed’s emphasis on data-driven decision-making and independence in policy formulation will guide its response to evolving market conditions. With Harker and Schmid’s perspectives shaping the dialogue on monetary policy, the Fed is poised to navigate the complexities of a changing economic environment with resilience and foresight.

Leave a Reply