Nvidia’s trajectory over the past couple of years can be likened to an exhilarating roller coaster ride, marked by rapid ascents and unexpected drops. As a frontrunner in the booming artificial intelligence (AI) sector, the company’s market capitalization soared to astounding heights, reflecting the enthusiasm surrounding AI technologies. However, this astounding growth has met with increasing volatility, posing both challenges and opportunities for investors. As Nvidia prepares to unveil its quarterly earnings, key insights into its market performance and strategic direction become crucial.

Since the end of 2022, Nvidia’s market value has ballooned to nearly nine times its prior worth, reaching unprecedented levels. This meteoric rise peaked in June when Nvidia briefly held the title of the world’s most valuable public company, a testament to its pivotal role in the unfolding AI revolution. However, this triumph was short-lived, as the company faced a steep decline, losing approximately 30% of its value, which translates to around $800 billion in market capitalization. Today, as Nvidia rallies back, inching closer to its all-time highs, stakes are higher than ever.

The anticipation surrounding Nvidia’s upcoming quarterly report is palpable. Wall Street is acutely aware that any indications of declining AI demand or tightening spending from major cloud clients could signal potential revenue regressions. The critical nature of Nvidia’s performance is emphasized by analysts, who recognize its role as a bellwether for the broader technology market. The sentiment encapsulated by Eric Jackson from EMJ Capital highlights this urgency: a disappointing report could trigger waves of concern across the entire sector.

Nvidia’s earnings report arrives in the wake of its big tech counterparts, whose earnings had significant ties to Nvidia’s offerings. Industry giants like Microsoft, Alphabet, Meta, Amazon, and Tesla are heavy consumers of Nvidia’s graphics processing units (GPUs), essential for training AI models and managing extensive workloads. Over the last three quarters, Nvidia has experienced a staggering tripling of annual revenues, primarily driven by its data center business. Analysts anticipate a similar performance for the upcoming quarter, expecting revenue growth of 112%, totaling around $28.7 billion. However, projections illustrate a challenging landscape ahead, with growth rates expected to taper over the next several quarters.

Investors eagerly look for guidance on the October forecast, with expectations hovering around a 75% revenue increase, amounting to $31.7 billion. This outlook is pivotal; a positive forecast could reflect sustained infrastructure spending by Nvidia’s affluent clients, while a downbeat projection might incite doubts regarding the sustainability of current tech expenditure levels.

Much of the optimism entering the quarterly report stems from encouraging comments made by Nvidia’s notable clients regarding their ongoing investments in data center capacities. Prominent figures in the technology realm, including the CEOs of Google and Meta, have underscored the necessity of these investments. They assert that underfunding their infrastructure poses a greater risk than the possibility of overspending. The demand for substantial quantities of high-performing processors showcases an insatiable appetite for growth within the AI domain.

Despite Nvidia’s rising profit margins, concerns linger about the long-term return on investment (ROI) that clients can expect from their sizeable purchases of GPU technology. Current insights suggest cloud service providers achieve an exceptionally favorable return—approximately $5 in revenue for every dollar spent on Nvidia chips within four years. Further disclosures regarding ROI metrics are anticipated, which could help shore up investor confidence.

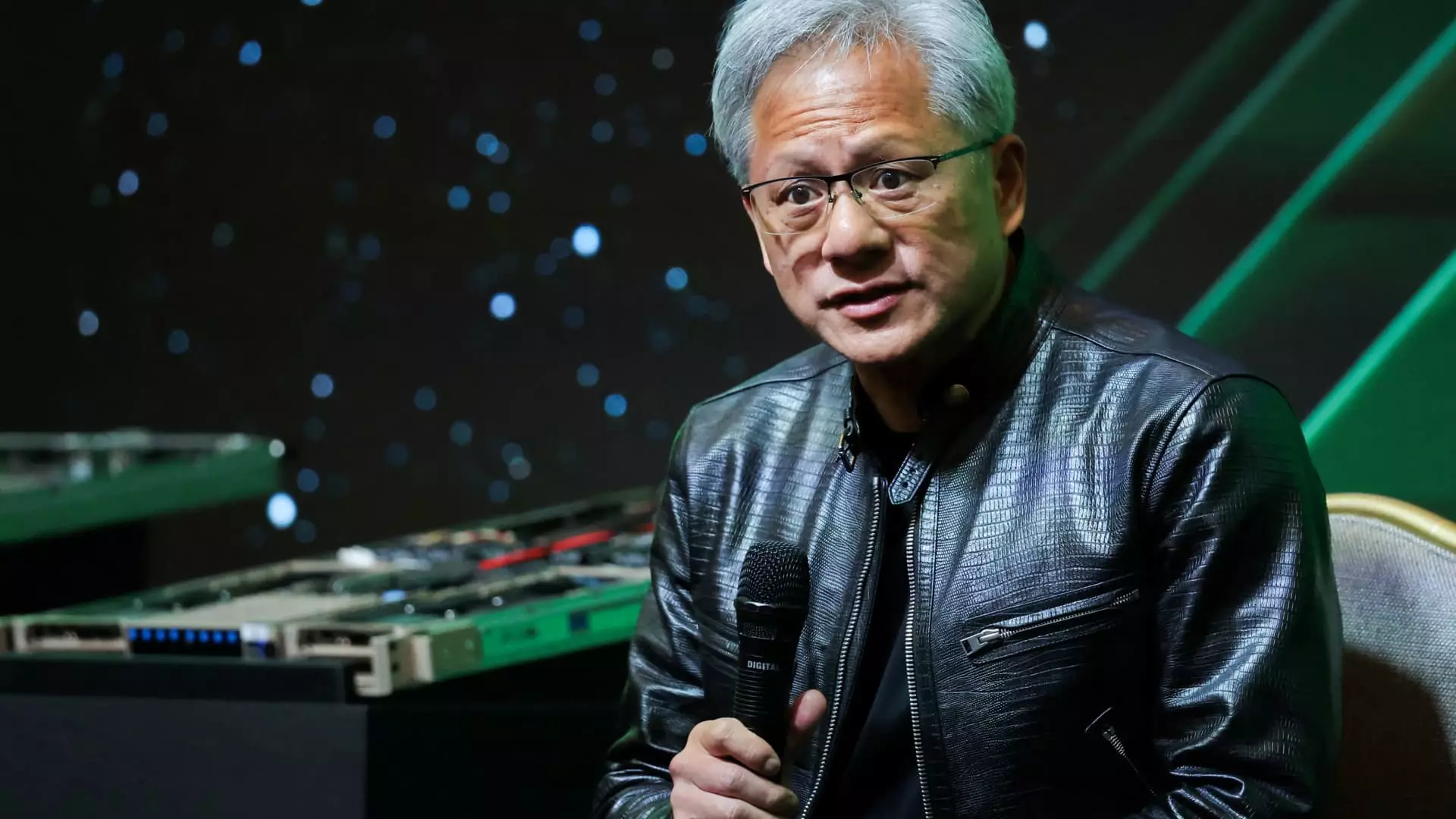

In addition to market expectations and client spending, Nvidia faces tough competition in the high-stakes AI chip arena. The anticipated launch of its next-generation AI processors, known as Blackwell, has encountered production challenges, potentially delaying significant shipments until 2025. Earlier assertions by CEO Jensen Huang, stating that Blackwell would contribute revenue this fiscal year, now seem to hang in the balance. Meanwhile, Nvidia’s current Hopper GPU series remains the preferred option for numerous AI applications.

As competition heats up with emerging players like Advanced Micro Devices and Google, maintaining Nvidia’s market prowess becomes crucial. It appears likely that Nvidia might shift its focus from Blackwell to ramping up production of Hopper chips, particularly the newer H200 variant, which shows promising performance in AI applications.

While Nvidia stands on the brink of revealing its latest financial numbers, the implications stretch far beyond the company itself. Investors will be closely scrutinizing both current performance and future projections, as the outcomes will reverberate throughout the technology sector. The confluence of AI-driven business models, competitive dynamics, and evolving client requirements will determine whether Nvidia can sustain its growth trajectory amid market complexities. Adaptability, innovation, and strategic foresight will dictate Nvidia’s path in an industry defined by rapid evolution and transformation.

Leave a Reply